Your Financial Status Is Our Goal

Explore More

About Us

Welcome to FinservKart, your trusted partner in navigating the intricate landscape of financial services. Established with a vision to empower individuals and businesses with smart financial solutions, FinservKart is committed to delivering excellence in every transaction.

Why Choosing Us!

Choose FinservKart for unparalleled financial solutions – our dedicated team, innovative approach, and 24/7 availability ensure a seamless experience tailored to your unique needs. Trust in expertise, choose FinservKart for your financial journey.

Explore MoreSwift and precise actions for optimal efficiency.

Providing expert navigation and direction.

Ensuring financial security for a resilient and prosperous future.

Our Services

Documents 1

Documents 2

Documents 3

Documents 4

Documents 5

Documents 6

Documents 7

Documents 8

Documents 9

Documents 10

Apply

PAN OF EACH DIRECTOR ( ATLEAST TWO DIRECTORS)

AADHAAR CARD NO OF EACH DIRECTORS (BOTH SIDE)

ELECTRICITY BILL FOR ADDRESS PROOF (LAST 60 DAYS)

BANK STATEMENT (LAST 60 DAYS)

FIRST PAGE OF BANK STATEMENT

PHOTO (PASSPORT SIZE) OF EACH MEMBER

MOBILE NO. OF EACH MEMBER

EMAIL ID OF EACH MEMBER

VOTER ID OF EACH MEMBER/ DRIVING LICENSE/PASSPORT

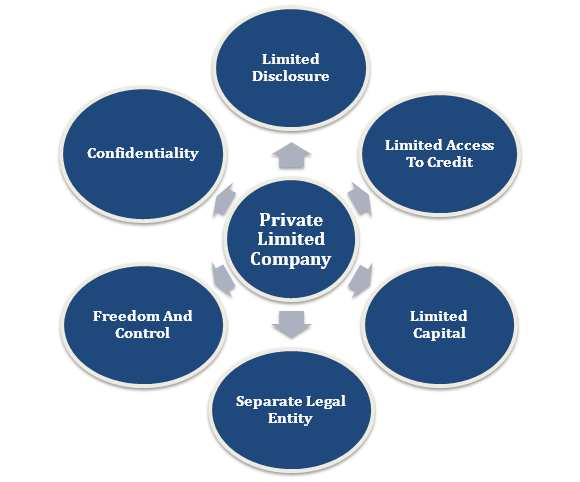

SERVICES PROVIDED BY US

ONE “NAME APPROVAL” OUT OF ANY FOUR PROPOSED NAME

TWO DIRECTOR IDENTIFICATION NUMBER (DIN)

TWO DIGITAL SIGNATURE CERTIFICATE (DSC)

INCORPORATION CERTIFICATE

PAN OF COMPANY

TAN OF COMPANY

GST NO

Apply

PAN card

Aadhaar card

Mobile Number

Email id

Electricity bill

IF Rented then rent agreement

Electricity Bill (If Property belongs to parents then Required No objection certificate (NOC)

1Passport size photograph

Name of Business

Apply

PAN Card

E Aadhaar

Bank Statement (From 1st Apr-31 Mar)

Investment Proof (Sec 80C)

Apply

Get In Touch